Boost your credit with on-time payments

Why consistency is the secret weapon

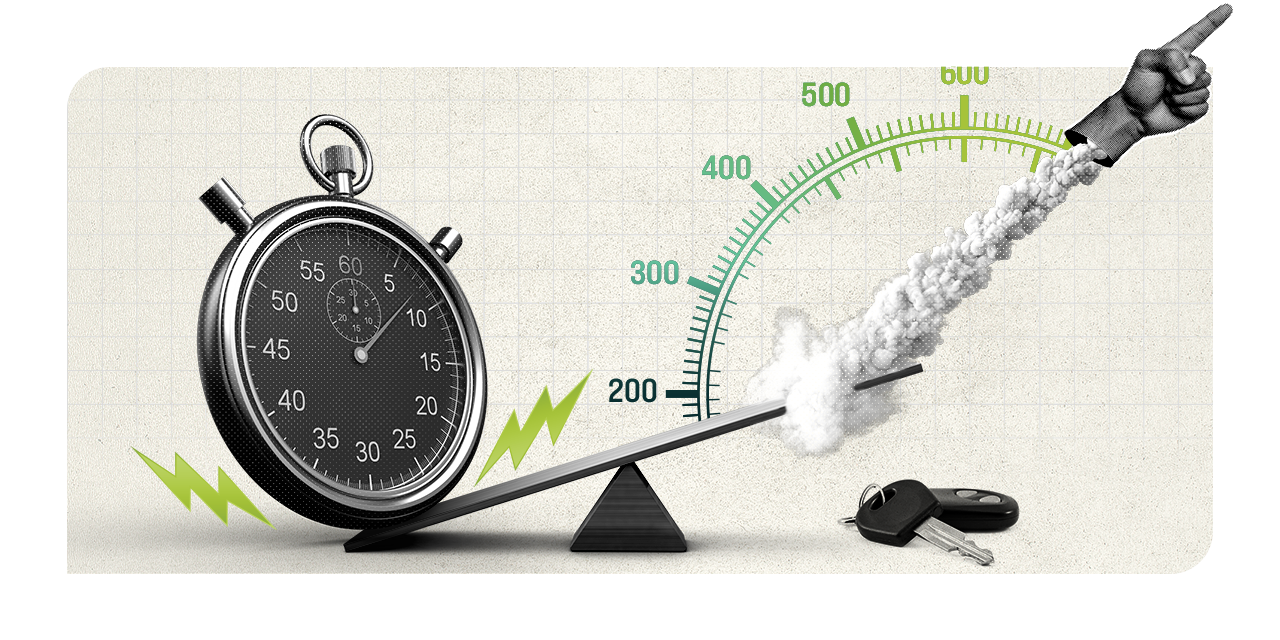

Think paying on time is just about avoiding late fees? There’s more to the story! Staying on top of your payments can actually boost your credit score, make it easier to get loans and open the door to better financial opportunities.

Why paying on time pays off

Here’s the deal: Your payment history makes up 35% of your FICO score, according to Experian, making it a crucial factor in maintaining strong credit. That’s a big chunk – so every payment counts. Pay on time? Great. Pay late or miss one? That shows up too, and it can hurt your score. The takeaway: Make on-time payments a habit to keep your credit score healthy and avoid any unnecessary dips.

Set yourself up for financial victory

Every time you pay on time, you’re not just dodging late fees and extra interest—you’re unlocking financial perks that can really add up. Consistency is your credit score’s BFF and could lead to:

- A rising cedit score with every on-time payment

- Snagging lower interest rates down the road

- Increased chance of loan eligibility

Pro tip: Let autopay do the work and drive you to a smoother financial future. Forget the “did I pay that bill” worries – sign up for autopay to save time and grant you convenience.

Consistency is key

On-time payments are your key to avoiding late fees, improving your credit, and securing a brighter financial future!

Want to learn what else impacts your credit score? Check out our blog, The blueprint to your credit score, for more tips.

Exeter Finance LLC is not a credit repair agency or licensed credit counselor. Exeter does not offer services to fix or improve credit scores. These tips are intended for general educational purposes and should not be construed as legal, financial, or credit repair advice.

You're leaving our site

You’re about to visit a third-party site. While we don’t control or endorse its content, we share this link to support your financial journey. Any information you provide or actions you take will be governed by their terms and privacy policies.