Credit scores: the 3-digit power players

4 reasons why your credit score matters

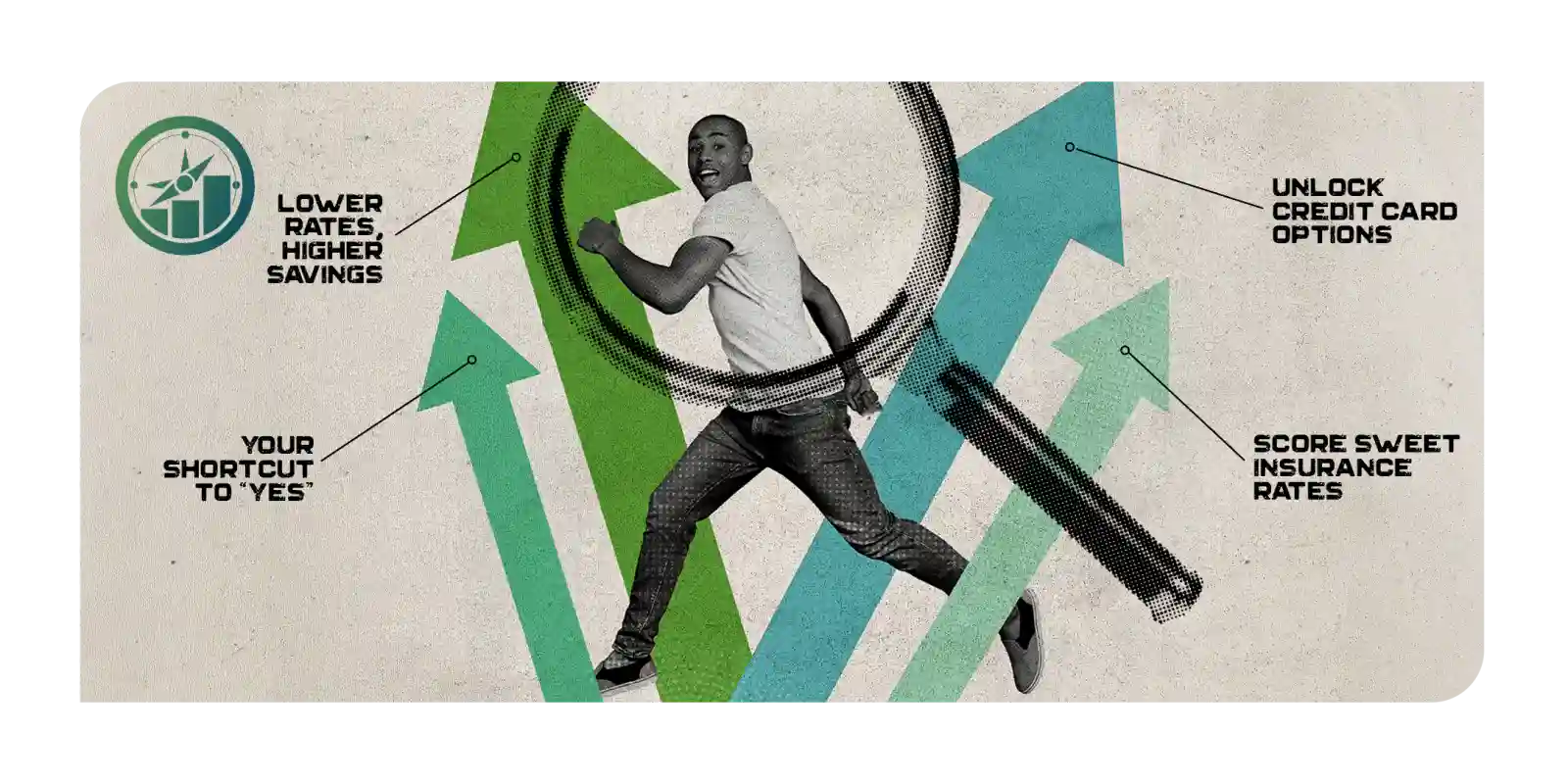

You know your credit score, but now what? Why does it matter so much? Your credit score isn’t just a random 3-digit number. With a high score, it’s your VIP pass to better interest rates, more loan approvals, and even your dream apartment. Yep, it’s kind of a big deal. Let’s dive into the nitty gritty details so you can take advantage of your high credit score and make major money moves.

1. Your shortcut to “yes”

Think of a good credit score like a giant green "YES”, button. Banks and lenders are way more likely to stamp that “approved” on your application when your credit looks solid.

- Needing a car loan?

- Dreaming of that first house?

- Launching that business idea?

A strong credit score can unlock all of those and more – faster than you might think. It’s not just a number; it’s a game changer.

2. Lower rates, higher savings

With a high credit score, you’re more likely to score lower interest rates, which saves you big bucks in the long run. That dream home or car? It’ll cost you less to pay off. Low credit score? Higher interest rates. And yep, that adds up quickly. But don’t panic because, guess what? Your score isn’t permanent! Check out our blog, Fix your credit like a pro for credit revival tips.

3. Unlock credit card options

Here’s a fun fact: your credit score plays a big role in the types of credit cards you can qualify for. A higher score doesn’t just improve your chances of approval – it also gives you access to cards with much better perks. These can include reward programs, cashback on purchases, and travel benefits.

4. Score sweet insurance rates

In some states, insurers use your score to determine your risk. Translation? A stellar credit score can help you unlock better deals on things like car insurance or even homeowners insurance. Think fewer premium payments and more dollars in your wallet.

Final thought:

Your credit score is your financial power tool. It holds the power to shape your lifestyle, from the car you drive to the credit cards you apply for. No matter where your credit stands – you’re in control. Start now and watch everything else fall into place!

Exeter Finance LLC is not a credit repair agency or licensed credit counselor. Exeter does not offer services to fix or improve credit scores. These tips are intended for general educational purposes and should not be construed as legal, financial, or credit repair advice.

You're leaving our site

You’re about to visit a third-party site. While we don’t control or endorse its content, we share this link to support your financial journey. Any information you provide or actions you take will be governed by their terms and privacy policies.